Email : info@gghospital.in | Phone : +91 99622 29940

This is a sort of Trial balance conducted when the financial period is already closed. Usually, the Post-closing trial balance is compiled some time after the period has finished practically. Business owners and managers use Post Closing Trial Balances for various analysis purposes, planning and budgeting.

The report prints the account number, description, and debitor credit balance for the beginning and ending period. The report can print incomestatement, balance sheet, or all balances for a selected range ofaccounting combinations. A post-closing trial balance is important for several reasons.

The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero. The post-closing trial balance is a crucial component of the accounting cycle, serving as the final step before a new accounting period begins. It is prepared after all closing entries have been made and posted to the ledger accounts. This trial balance ensures that all temporary accounts have been closed properly and that only permanent accounts remain with balances. By verifying the equality of debits and credits, the post-closing trial balance confirms that the accounts are ready for the next accounting period. It is used to verify that the total of all debit balances equals the total of all credit balances, which should be net to zero.

The Balance Sheet, therefore, can’t be finalized, which would obviously be disastrous. A Trial balance is a measure designed to see if all the transaction entries over the course of an assessed accounting period add up. It is necessary to prepare a post-closing trial balance to show the final balance of the company account to continue for the next year. The accounting department must constantly monitor the operations performed and keep records for the tax authorities.

Like more trial balances, the debit and credit columns are totaled at the bottom to ensure the accounting equation is in balance. Running a trial balance helps keep a close eye on account balances budget report definition, example how it works and their accuracy. Human oversight is needed as software alone can’t ensure everything is right. Ending the cycle with a post-closing trial balance shows the earnings retention ratio clearly.

Moving from an adjusted trial balance to a post-closing trial balance requires careful work. They move earnings to the retained earnings account and reset other accounts for the future. Adjusted trial balance is key for an exact post-closing trial balance. This step in the accounting cycle needs detailed use of accrual accounting rules to show real financial status. Accruals, showing earned revenues or incurred expenses, are noted even without cash transactions.

First, the trial balance was incorrectly prepared and didn’t accurately transfer closing entries to the ledger account. Second, there may be a mistake while creating closing journal entries. Completing the accounting cycle correctly is crucial for corporate governance and truthful financial statements. It comes after closing entries are put into the general ledger. It makes sure statements like the cash flow are accurate and truly represents the company’s financial health. A post-closing trial balance is a financial report prepared at the end of an accounting period to ensure that all temporary accounts have been closed and the company’s books are balanced.

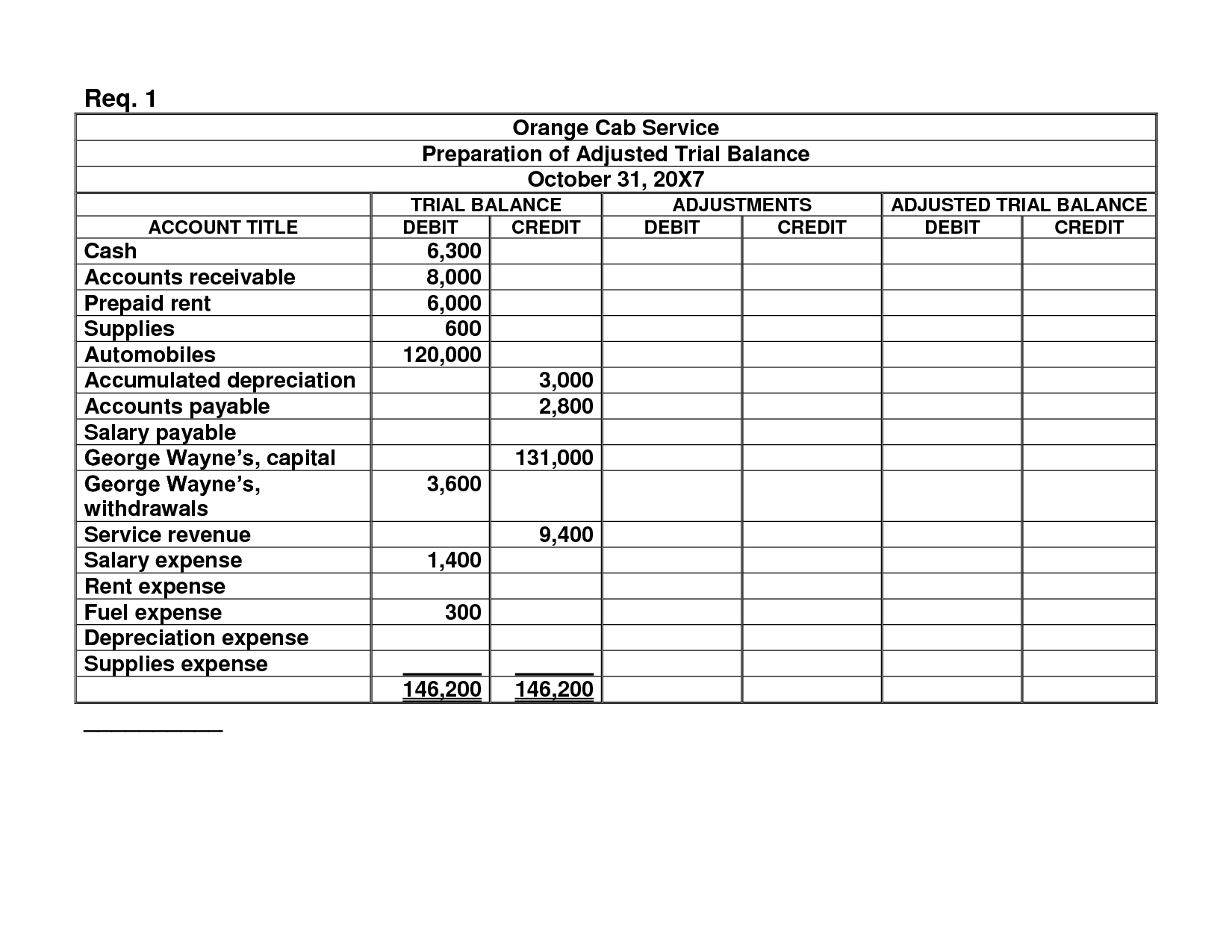

Now the ledger accounts just have post closing entry totals. As with all financial reports, trial balances are always prepared with a heading. Typically, the heading consists of three lines containing the company name, name of the trial balance, and date of the reporting period. Like all financial reports, a post closing trial balance should be prepared with a heading. The preparing adjusted trial balance comes after recording and post-adjusting entries. The main purpose is to test equality between debit and credit after preparing the adjusting entries.